Download Form 16 For Salaried Employees Form 16 is an important document for salaried employees in India as it serves as proof of tax deducted at source (TDS) by the employer. It helps in filing income tax returns (ITR) and provides a detailed account of salary income and TDS deduction. If you are wondering how to download Form 16, this guide will explain you the entire process step by step. https://www.incometax.gov.in/

What Is Form 16? – Download Form 16 For Salaried Employees

Form 16 is a certificate issued by the employer to salaried employees, containing a summary of their income and TDS details. It consists of two parts:

Part A: It contains details of the employer and employee, PAN, TAN and a summary of TDS deducted.

Part B: Provides a detailed breakdown of salary components, deductions and taxable income.

Who Issues Form 16? Download Form 16 For Salaried Employees

Employers issue Form 16 to employees whose salary exceeds the taxable limit and TDS has been deducted. If no TDS has been deducted, the employer may not provide Form 16, but the employee can still file ITR using the salary slip and Form 26AS.

पहले अच्छे दिखो फिर अच्छे बनो

“पहले अच्छा दिखो, फिर अच्छा बनो” Setu Skin Renew Aapke आंतरिक अच्छाई और गुणों को विकसित करने से पहले उपस्थिति और आचरण के माध्यम से सकारात्मक पहली छाप बनाने के महत्व पर जोर देता है। यह सुझाव देता है कि बाहरी प्रस्तुति दरवाजे खोल सकती है, लेकिन सच्चा चरित्र सम्मान और सफलता को बनाए रखता है।

How To Download Form 16 For Salaried Employees ?

How To Download Form 16?

Download from employer’s portal

Many organisations provide Form 16 through their internal portal. You can access it like this:

Log in to your company’s HR or payroll portal.

Go to the ‘Tax Documents’ or ‘Form 16’ section.

Download Form 16 for the relevant financial year.

Request from employer

If your employer does not have an online portal, you can request Form 16 from the HR or finance department. They can provide it via email or a printed copy.

Get it through TRACES (for employers)

While individual employees cannot download Form 16 directly from the government website, employers generate it through the TRACES (TDS Reconciliation Analysis and Correction Enabled System) portal.

Employers follow these steps:

Log in to TRACES using your credentials.

Select ‘Downloads’ and select ‘Form 16’.

Enter details such as PAN, assessment year and other required information.

Download Form 16 and distribute it to employees.

Use Form 26AS as an alternative

If you do not receive Form 16, you can check Form 26AS for TDS details. Follow these steps:

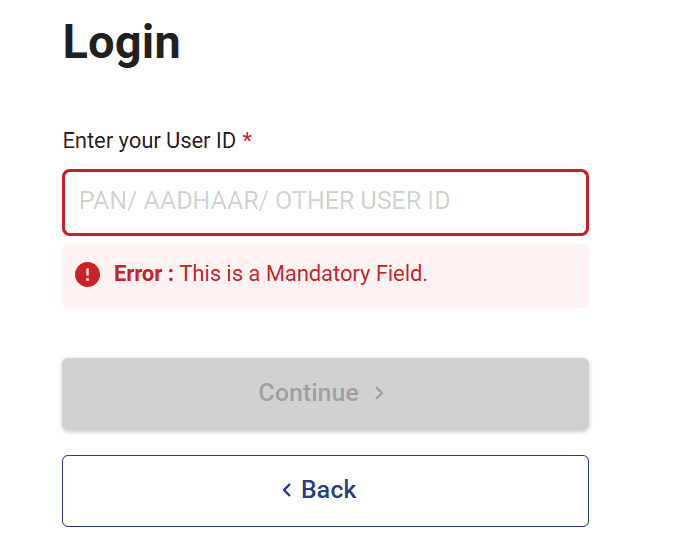

Go to the Income Tax e-filing portal.

Log in using your PAN and password.

Go to ‘My Account’ and select ‘View Form 26AS’. Download the document to check tax deduction.

Frequently Asked Questions (FAQs) Download Form 16 For Salaried Employees

Can I download Form 16 directly from the Income Tax website?

No, only employers can generate and issue Form 16. Employees have to obtain it from their employer.

What if my employer refuses to issue Form 16?

You can still file your ITR using Form 26AS and salary slips to calculate your taxable income and TDS.

Is Form 16 mandatory for filing ITR?

Not always. If your income is below the taxable limit or you have other income sources, you can file ITR without Form 16 using salary details and Form 26AS.

When is Form 16 issued?

The employer has to issue Form 16 by June 15 of the next financial year.

Conclusion Download Form 16 For Salaried Employees

Download Form 16 For Salaried Employees is a simple process, but it must be obtained from the employer. If you do not receive it, alternatives like Form 26AS can help you file your ITR easily. Make sure you collect Form 16 on time to avoid last-minute tax filing issues.By following the steps mentioned above, you can easily download and use Form 16 for tax filing and financial planning.

पहले अच्छे दिखो फिर अच्छे बनो

“पहले अच्छा दिखो, फिर अच्छा बनो” Setu Skin Renew Aapke आंतरिक अच्छाई और गुणों को विकसित करने से पहले उपस्थिति और आचरण के माध्यम से सकारात्मक पहली छाप बनाने के महत्व पर जोर देता है। यह सुझाव देता है कि बाहरी प्रस्तुति दरवाजे खोल सकती है, लेकिन सच्चा चरित्र सम्मान और सफलता को बनाए रखता है।

Some Use Full Links Related Download Form 16 For Salaried Employees

| Download Form | Click Here |

| Income tax ITR | Click Here |

| Official Website | Click Here |

| Related Post | Police Verification Form Download |

| Join Government Result Hub | Telegram|Facebook|linked |YouTube|Whatsapp Group |

Latest Storie

Video Process Download Form 16 For Salaried Employees

पहले अच्छे दिखो फिर अच्छे बनो

“पहले अच्छा दिखो, फिर अच्छा बनो” Setu Skin Renew Aapke आंतरिक अच्छाई और गुणों को विकसित करने से पहले उपस्थिति और आचरण के माध्यम से सकारात्मक पहली छाप बनाने के महत्व पर जोर देता है। यह सुझाव देता है कि बाहरी प्रस्तुति दरवाजे खोल सकती है, लेकिन सच्चा चरित्र सम्मान और सफलता को बनाए रखता है।